5 Dangers of Over-Diversifying your Portfolio

Table of Contents

5 Dangers of Over-Diversifying your Portfolio

One of the most common portfolio management tips given to clients is to ‘diversify’! If the execution is correct, diversification can reap many benefits for you, but going overboard with diversification can lead to complications, increased risks and, lower returns. Popular American money manager, Peter Lynch, in his book, One Up on Wall Street, talks about over-diversifying portfolios or as he termed it ‘diworsification. Let’s try to understand what it means to over-diversify a portfolio.

Over-Diversifying Portfolio: What does it mean?

In simple terms, diversifying comes from the phrase, “Don’t put all your eggs in one basket.” Many financial advisors advise their clients to not invest in just one type of asset. For example, you must have heard financial advisors asking you to not invest in real estate alone, and instead, invest in another sector or type of company, like pharmaceuticals or technology. Your financial advisor may be right as diversification does reduce the risk of loss, but only as long as it does not lead to over-diversification.

Over-diversifying portfolios or Diworsification, as explained by Peter Lynch, occurs when you invest in way too many assets and bring a higher possibility of risk to your portfolio. Over-diversification happens when the number of investments exceeds to such an extent that the marginal loss of expected return is more than the marginal benefit of reduced risk. Confused? In simple words, it means, by adding too many assets to your portfolio, the positives of some investments and companies are cancelled by the negatives of others. Many problems come with over-diversifying your portfolio. Some of them have been discussed below:

5 Dangers of Over-Diversifying your Portfolio

1. Over-Diversifying a Portfolio confuses you

To be able to make the most of your investments, it is essential to follow quarter and annual reports of your invested stocks. Companies also frequently make corporate announcements that can be highly relevant to you in relation to your investments. With your job, family and a million other things to do on a daily basis, it can be very difficult to regularly monitor 50 different stocks. On the other hand, if you had just 10 stocks, it would be easy to make a note of them all.

2. Poor choice of Investment

Most investors who over-diversify their portfolios use investment vehicles like actively traded mutual funds. Actively traded mutual funds generally tend to focus on short-term trading instead of adding value to your investment. These funds usually underperform in the long run.

3. Over-Diversifying a Portfolio makes things complicated

It is important to know what you invest and where you invest it. Adding too many assets in your portfolio and not knowing what is in them can be catastrophic. It is important to be in charge of your stocks and take the wheel in your hands.

4. Low returns on Investment

One of the most evident dangers of over-diversifying a portfolio is to receive low returns on your investment. Imagine this scenario; if you own 5 stocks, your portfolio has high risks but also a high possibility of good returns. But if you have 100 stocks, your portfolio risk is definitively low, but so is your expected rate of returns.

5. Over-Diversifying a Portfolio because of mistaken correlation

While diversifying, most investors only look at static figures of correlation. It is possible for two securities to be extremely correlated at a certain period and be absolutely uncorrelated at other times.

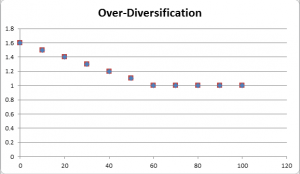

Over-Diversification

The risk decreases as the number of stocks increase, but remains constant beyond a point

Signs of Over- Diversification

If you are unable to decide whether or not your portfolio has been over-diversified, look for these sings:

- If you have many mutual funds under one investment style, your portfolio is over-diversified. This increases your risk as well as investment costs.

- Having too many individual stock options is another sign. This will require you to constantly review and monitor your investments. Your portfolio will also function like a stock index but at increased costs, thereby affecting your overall profits.

- If you own private ‘non-traded’ investments you may suffer from the pitfalls of over-diversification. These instruments are often marketed for their diversification attributes, but they also carry a lot of risk.

- Opting for multimanager investments is also an indicator of over-diversification. While hiring professionals for advice can be a good strategy to cash-in on current market trends, it can also be a costly affair and results in over-diversification.

Why do Some Advisors Choose Over-diversification?

There may be many reasons why some financial advisors suggest over-diversification. Some may genuinely falter between the faint line between diversification and over-diversification. Others may do it to earn more money and ensure better earnings for themselves. Some advisors may over-diversify so they do not end up losing their clients over poor returns. Moreover, auto diversification instruments like target date funds have also contributed to this problem. In addition to this, some advisors appoint third-party investment managers that leads to over-diversification. They do this because it considerably reduces a financial advisor’s work, while increasing their chances of earning more commission from buying and selling different investments.

5 Successful Portfolio Management tips

1. Prefer quality over quantity to avoid Over-Diversification

A good portfolio is one that reflects quality investments and not necessarily a huge quantity of investments. A cardinal portfolio management tip is to concentrate on quality. An over-diversified portfolio creates an illusion amongst investors that they are secure against risks when in reality, many diversified investments actually share the same risk factors.

2. Keep it simple

Finance can be a tricky subject and many a time, investors find it difficult to understand the nuances of their investments. Try to not blindly follow a friend’s advice and go on over-diversifying your portfolio. The most profitable portfolio management tip of all times is to keep things simple. Less is more! Make sure you understand which assets bring in returns and which bring in risk.

3. Opt for optimum Diversification and not Over-Diversification

Different industries are unlikely to fluctuate at the same time. This is why investors opt for diversification in the first place. Optimum diversification is to use multiple stocks that are not only good enough to reduce unsystematic risks but also good enough to tap into the best possible opportunities.

4. Go local

Instead of opting for foreign stock investment vehicles, go in for American stocks. With such stocks, you are already getting exposure to overseas markets indirectly. Evidently, an American company would pay better attention to their stocks than you would individually. Keeping in mind this portfolio management tip not only reduces risk but also ensures that your portfolio is simple and easy to manage.

5. Consider rolling Correlation

The easiest tip for better portfolio management is to comprehensively reflect on the correlation between your stocks. Instead of only studying the static correlation between your securities for a period of one or two years, consider studying the rolling correlation over a longer period of time.

To sum it up

The most important portfolio management tip is to understand that no matter how diversified your portfolio is, it can never be truly eliminated from all risks. Over-diversification only creates a false sense of confidence in investors. The CEO of Berkshire Hathaway, Warren Buffett, rightly said, “Wide diversification is only required when investors do not understand what they are doing”. Over-diversifying your portfolio merely makes things complicated and chaotic. It has little or no effect on reducing risks or increasing your returns.

Do you think you are over-diversifying your portfolio? Reach out to financial advisors to understand how you can simplify your portfolio to reduce risks and have better returns.